Sabrina Gordon, Business Reporter

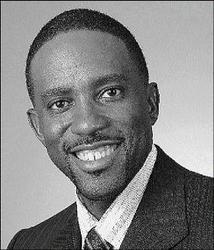

Mark Thompson, chief executive of Advantage General Insurance.

In its first full year under the ownership of Michael Lee Chin's AIC group, Advantage General (AGI) sharply turned around its loss of 2006 and the new managers say that will diversify its heavy dependence on motor-vehicle insurance to maintain profits and drive growth.

However, CEO Mark Thompson has made it clear that AGI has no intention of surrendering its leadership in the motor-insurance market.

"The focus of the company has been on improving the customer services and thereby entrenching its lead position as the largest motor vehicle insurer in Jamaica while effectively reducing the risk level of its motor portfolio," Thompson told Wednesday Business.

"The company will also be focusing on diversifying its portfolio in order to further reduce its loss ratio for 2008 and onwards. In doing so, the company is cognisant of declining rates in a softening property market in 2008 and as such, will be very selective in the risks its underwrites."

Reversed performance

Thompson had charge of Cable and Wireless Jamaica's finances before he took up the job running AGI last August. He replaced Andrea Gordon-Martin.

Advantage General used to be Neville Blythe's highly leveraged United General Insurance Company (UGI), of which Lee Chin acquired 80 per cent in 2006 as part of a deal that included majority stake in a media group that includes CVM Television, HOT 102 FM, and the weekly tabloid newspaper, XNews.

In its financials for 2006, AGI reported a restated loss of $120.47 million.

But in the year to December 31, 2007, that performance was reversed to a net profit of $343.24 million. The profit came on the back of gross insurance premium revenue of approximately $3.2 billion, six per cent higher than the previous year.

However, net premium income at $2.34 billion was nearly a billion dollars, or 71 per cent better than in 2006, when the premiums ceded to reinsurers were $1.33 billion, roughly twice last year's outflow.

Additionally, the company was able to contain its growth in operating expenses to 12 per cent, at $779.26 million. But Thompson said he wants to do better in this area.

Enhanced service

While AGI has the lion's share of the motor-insurance sector, critics argued that under its previous owners, the company took on marginal risks.

In fact, the old UGI also had a reputation for its slow honouring of claims, which analysts say might have been partly due to the sheer size of its portfolio and deficiencies in technology and internal management systems.

"Our simple focus will be to provide enhanced claims service and to continue to strengthen our position as the number-one motor insurer in the Jamaican market," Thompson told Wednesday Business.

The insurance company has a 17 per cent share of the general insurance market with some 80,000 policyholders.

Overall, it is number two in the general-insurance market.

But even as Thompson plans to grow the business, he expects to keep a tight lid on its loss ratio, which last year, reached approxi-mately 75 per cent.

This was primarily because of the impact of Hurricane Dean and the growth in the company's motor portfolio business, which carries a higher loss ratio.

Reduce loss ratio

Loss ratio, that is the dollar amount of claims paid out to premiums collected, is the metric used to determine profitability on insurance portfolios. It determines how much of the premium dollar is paid back out in claims.

"For 2008, our intention is to reduce the loss ratio to the mid 60s by diversification of portfolio mix and some rationalisation in our motor portfolio," he said.

sabrina.gordon@gleanerjm.com