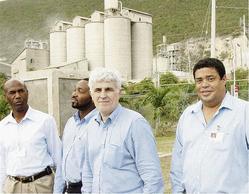

Paolo Lombardo (centre), environmental specialist at the International Finance Corporation (IFC), is accompanied on a tour of the Caribbean Cement Company plant at Rockfort, Kingston, by CCC representatives. From left are Balfour Denniston, Ken Wiltshire and Anthony Haynes. IFC is a financier of the US$177 million cement plant expansion and modernisation. - Rudolph Brown/Chief Photographer

All but free of faulty cement claims that ate into profits two years ago Trinidad owned Caribbean Cement Company Limited (CCC) has made more than half a billion in profit at yearend December 2007 largely on the back of big sales revenue.

At the same time, the company has reported a revised figure for its plant improvement project, saying the expansion and modernisation of the Rockfort, Kingston based operation was a US$177 million investment — or J$12.6 billion at current exchange rates - with spend in 2007 amounting to $1.1 billion.

The cement manufacturer sold 813,448 tonnes of cement into the market last year, considerably less that the 843,295 tonnes supplied in 2006, saying the current sales represent an 84 per cent lock on the market at one point climbed even higher in a year when the market was hit by cement shortages.

Market share

"For the last four months of 2007, when the cement importers stocked out of product, our market share averaged in the 90 percentiles," said company directors, chairman Brian Young and Judith Robinson, in the director's statement accompanying the accounts.

But the sales also resulted in a $1.1 billion gain on the company's top line income, from $6.7 billion or to last year's $7.8 billion, suggesting that the CCC sold cement at a considerably higher price into the market last year — earning $9,647 per tonne in 2007 against $7,982 per tonne in 2006.

Carib Cement said its enhanced revenues were "driven primarily by a pricing policy that addressed the increase in energy sensitive inputs".

But the company also trumpeted corrections to its plant, saying measures to address "identified shortcomings after the inadvertent releases of non-conforming cement" released in the market in 2006, saying the improvements also boosted performance in the current period.

Indeed, the company's operating profit grew seven-fold to $797 billion, against $117.7 billion in 2006 when the company paid out more than $304 million for faulty cement claims.

Last year's pay outs dropped to $21.5 million, with the company reporting that up to the end of December, it had settled with 99 per cent of claimants.

Carib Cement also faced higher financing costs of $142 million, virtually doubling the $75 million charges in the prior period, while its corporate taxes blazed to $137 million or more than seven times the previous year's $18 million, but its net profits still rose seven fold to $522 million or 61 cents per share (2006: $77 million/nine cents per share).

The bottom-line figure was inflated, the company said however, by a $154 million one-off gain on disposal of assets, linked to an insurance settlement for damage to its coal pier.

All of the profits are to be retained by the company, with Young and Robinson noting that the board thought it prudent to flow all internally generated funds to the ongoing project.

As a result, the company, which is majority owned by Trinidad Cement Limited, will pay no dividends for 2007.

The profits have instead flowed to the balance sheet, boosting equity in the company from $2.7 billion to $3.15 billion.

Initially, the cement plant upgrade, which should increase the plant's capacity by 80 per cent, was announced as a US$120 million project, but it has faced delays from adverse weather.

Kiln No. 5 is to be completed by the second calendar quarter.

And already, Carib Cement has broken ground for the new cement mill. A contract award for the foundation works is pending, the company said.

business@gleanerjm.com