Susan Gordon, Business Reporter

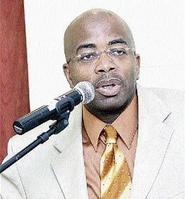

Curtis Martin, president of CCMB.

The Capital and Credit Financial Group (CCFG) in the final stages of restructuring its operations, will be delisting the ordinary shares of Capital and Credit Merchant Bank (CCMB) stock from the Jamaican and Trinidad stock exchanges.

Simultaneously, CCFG will apply for listing in the two markets.

But the Ryland Campbell-led company, which had said that the restructuring would have resulted in the transfer of over 468 million or 73 per cent of shares from the merchant bank into CCFG by the end of 2007, is also looking to create more than 42.7 million CCMB preference shares.

Group deputy president and CCMB Chief Executive Officer, Curtis Martin, told Wednesday Business that the pref issue would serve as bonus shares for its shareholders.

Bonus issue

The bonus issue is to be allotted at the ratio of one CCMB pref for every 15 CCMB ordinary shares held by the shareholders.

Simultaneously, as CCMB delists, CCFG will list its shares. But CCMB will also apply to list its newly issued prefs.

Martin said, however, that the group was unable to say when the process would be completed, nor had any decisions been finalised on the terms of the preference offer.

"The board has not decided on when exactly the listing or delisting will take place," Martin told Wednesday Business when asked of the development.

CCMB has issued shares of 641,159,670, with the bulk of its shareholders domiciled in its home market: 2,135 shareholders on the JSE, and 1,472 on the TTSE.

The company's legal counsel, Trudy-Ann Bartley-Thompson, said the prefs would allow wider investor participation in CCFG.

"Persons who own CCMB shares will now own a piece of the group," said Bartley-Thompson.

The group has one billion of authorised ordinary shares and 500 million preference shares which it intends to apply to be listed on the JSE and TTSE. Westar Finance, Westar Group, the National Investment Fund (NIF) and Andrew Cocking are its top five shareholders, with a combined 720 million of the ordinary shares.

CCFG would be looking to list the remaining 280 million ordinary shares plus its 500 million preference shares.

The plan is subject to shareholder approval to be sought at a meeting still to be convened.

susan.gordon@gleanerjm.com