Susan Gordon, Business Reporter

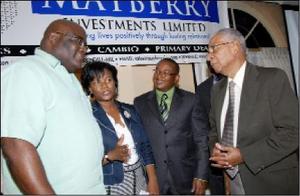

Supreme Ventures CEO Brian George (left) is seen here with (from left) Mayberry Investment's adviser Odessah Wade, Vice-chairman Konrad Berry and managing director of investments Erwin Angus at the Mayberry Investment Forum, February 21, Knutsford Court Hotel, New Kingston. - Contributed

Supreme Ventures Limited (SLV) will this year crosslist on the Trinidad Stock Exchange and strengthen its gaming operations in a move to build value and revenues in the year ahead.

But while Chief Executive Officer Brian George was unprepared to say what value the company expected immediately by entering the Trinidad equity market, he was clear that SVL was not inclined to set up new gaming operations in the region.

"The lessons learnt in seeking to operate other business in other countries," said George, "are fraught with challenges."

Scant on the details

Instead, George, who last week addressed the investment community at the monthly Mayberry Investors Forum, is looking outward towards Europe. There is the possibility, he said, of SVL partnering with a Greek gaming company but, again, he was scant on the details.

Last year, SVL earned revenues of $18.9 billion across the group, a gain of $3 billion year over year, but the lottery company 's cost of making those sales also grew by $2.5 billion - prize payouts for example rose from $9.8 billion to $12.2 billion - leaving a net gain of half a billion dollars at the gross profit line.

At the bottom line, the company's performance was stellar, with net profit growing almost 2.5 times from $165 million at October 2006 to $405 million at October 2007.

Video lottery terminal's (VLT) portion of revenues rose from $556 million to $803 million, while its contribution to operations swung to $37 million in a

turnaround of the $61 million drain on the company in 2006.

George sees even greater promise in the business segment - which represents a mere four per cent of group turnover - saying the target is to grow Video Lottery Terminal (VLT) revenues by 40 per cent to $1.15 billion this year.

"We are trying to drag up revenues," he said at the forum.

"We would like to grow the number of times visitors move into the stores from three per week to four."

Much of that forecast is based on expectations of the potential earnings the company believes Acropolis May Pen represents - the gaming lounge, which was outfitted at a cost of $125 million, opened for business in November 2007 - as well as plans to expand.

Rapid expansion

"You may not see a rapid expansion of our gaming lounges but there are areas in our community where there is scope for expansion," said George, signalling that more gaming lounges would emerge but holding back on the details, he said, for competitive reasons.

SVL also hopes to entice more customers into its flagship Barbican gaming lounge as well as the Villagio located at the Hilton Kingston hotel and Coral Cliff in Montego Bay.

On the flip side, the company hopes to contain prize payouts to 72 per cent compared to last year's 76 per cent.

Cash Pot remains its most lucrative game, hauling in $13.6 billion of revenues (2006: $11.4 billion), followed by Lotto with $1.3 billion and Pick 3 with $1.1 billion.

susan.gordon@gleanerjm.com