Susan Gordon, Business Reporter

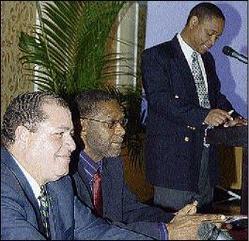

Dennis Chung, chartered accountant and consultant, welcomes Minister of Finance and the Public Service Audley Shaw (left), guest speaker at the Investor's Choice Investment 2008 Seminar, Terra Nova All-Suite Hotel, on Wednesday. At centre is conference organiser and presenter John Jackson. - Junior Dowie/Staff Photographer

Government is actively considering reducing the corporate tax rate to equalise with that of personal income tax, Minister of Finance Audley Shaw said Wednesday night.

If Shaw were to follow through on the cut it would give businesses a more than eight point reprieve.

Companies now pay 33.33 per cent in income tax, while their employees pay 25 per cent.

The Minister, speaking at the annual Investor's Choice Inves-tment '08 seminar in Kingston, said the measure was under consideration as a means of boosting tax compliance.

"Tax compliance is an important feature to run the country," said Shaw, a guest speaker at the event. "Why should compliance be a disincentive?"

But like other proposed tax cuts that are pending, notably real estate taxes, the Minister did not give a time line on when a decision was likely.

Corporate taxes is the worst performer in terms of compliance, Shaw told seminar participants, saying a reduction in the rate could be the incentive needed by that group to pay up.

Compliance, as well as evasion, remains a real challenge for the tax authorities.

Last November, Financial Secretary Colin Bullock revealed that the rate of tax compliance was only 30 per cent, but that the rate of corporate tax compliance was even worse, at 10 per cent.

Asked by a seminar participant whether a tax amnesty would be considered, Shaw suggested it was not a priority consideration.

"We are looking at all the options," said the finance minister.

"(But) we intend at first base to put in an aggressive programme to stimulate voluntary compliance; that's my first base," he said.

susan.gordon@gleanerjm.com