The emergency cut in interest rates by the United States central bank will have no immediate direct effect on local markets, brokers said Tuesday.

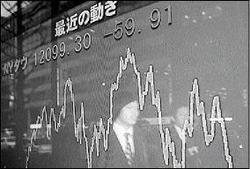

The U.S. Federal Reserve cut rates by three-quarter point to 3.5 per cent Tuesday to revive confidence after world markets tanked Monday on fears that a U.S. recession was inevitable.

"The bond market is where there would be some impact," said Christopher Chin-Loy of Dehring Bunting and Golding.

Expectations are that as interest rates fall in the U.S., investors there will switch to higher-yielding emerging market bonds.

Load up on tech stocks

Mark Croskery, chief executive of Stocks and Securities Limited, said the U.S. bond market's reaction to the news saw treasuries trading higher Tuesday. This, he said, would benefit Sagicor's and government-issued bonds.

Croskery's recommendation is for investors with holdings in overseas markets to load up on tech stocks that got hammered in the market downturn, such as Apple, Oracle and Research in Motion.

Surprise reduction

The Fed, confronted with a global stock sell-off, indicated after an emergency session Monday night that further rate cuts were likely. The central bank's next meeting is January 28-30.

The surprise reduction in the federal funds rate from 4.25 down to 3.5 per cent marked the biggest funds rate cut on record going back to 1990. The discount rate charged to banks was cut to 4.0 per cent.

Despite the Fed's move, U.S. stocks still fell the market recovered more than 280 points of an earlier 465 drop in the early sessions.

>

sabrina.gordon@gleanerjm.com