Susan Gordon, Business Reporter

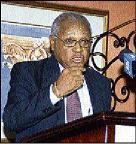

Byron Thompson, managing director of the Seprod Group of companies. Thompson says the company is hunting new acqusitiions to be financed with proceeds from divestment of its interests in several Musson Jamaica companies. - Winston Sill/Freelance Photographer

Following the announcement that it would sell its 50 per cent interest in the US$40 million Gatcombe Investment by the start of this month, Seprod Limited now says it will be divesting its interest in its St. Lucian-based associated companies Productive Business Solutions Limited and CBM Limited.

The company is in negotiation with its partner Musson (Jamaica) Limited to sell its 50 per cent shareholding in the two document companies, which operate regionally in St. Lucia, Dominican Republic, Aruba and Curaçao.

"Musson will own those (associated companies) in their entirety, assuming we come to an agreement," said Thompson.

The Seprod boss told Wednesday Business that one of the decisions to sell was linked to the delays in auditing accounts due to the diverse jurisdictions.

Seprod is a listed company, trading on the stock exchange, requiring timely disclosure of financial reports.

Musson is a private operation headed by Desmond Blades.

Thompson said the two companies were also private entities seeking to grow in their markets, indicating that there was some disquiet about divulging information to a public company, saying the companies were in growth mode.

"These businesses are the dominant player in the market," he told the Financial Gleaner. Their business centres on photocopying, machine repair and servicing.

Thompson would not divulge the expected value to be gained from a sale of the interests, saying only that Seprod's stake in the two was smaller in value than its interest in Gatcombe.

He also told the Financial Gleaner that this current deal, if successful, would be the end of the unbundling programme with Musson.

The proceeds will fund new acquisitions.

"We are going to invest the money in a way that we won't be worse off from the divestment," he said. "In the same manner that Seprod has bought the biscuit company (Kraft's local assets), it is looking at other options."

Musson still remains the largest shareholder of Seprod with a little over 41 per cent shareholding.

Thompson said the divestment would not affect Musson's shareholding in Seprod.

susan.gordon@gleanerjm.com