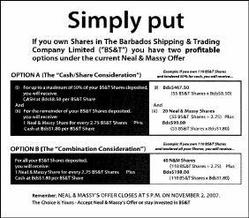

A section of an advertisement by Neal and Massy Holdings to simplify the 100 per cent takeover offer made to shareholders of Barbados Shipping and Trading.

Neal and Massy Holdings Limited has extended its takeover offer for Barba-dos Shipping and Trading Company by two and a half weeks, and at the same time is seeking to calm jitters over what seems to be a pending court fight with regulators.

The company has left open the possibility of a further extension of its takeover offer beyond the new date of November 19, or even its withdrawal, over uncertainty of the outcome of the high court's perusal of actions by Neal and Massy and its former bid rival AMCL Holdings, a subsidiary created by ANSA McAL.

"Neal and Massy is cognisant that recent statements made by the commission may have caused some level of uncertainty," said Neal and Massy Chief Executive Officer Bernard Dulal-Whiteway in a statement issued early Thursday.

Investor jitters

But the company's combination cash and shares offer price for BS&T, which remains the same under the extension, appears to be a contributing factor to investor jitters, forcing Neal and Massy to publish advertisements this week simplifying for shareholders the actual amount of funds and/or shares they will get in return for giving up their BS&T stock.

The Barbados Securities Commissions (BSC), regulator of the stock market, has put a hold on the trading of BS&T shares on the Bridgetown-based exchange, over what it perceives as questionable tactics by the two Trinidad companies in a series of bids and counter moves, driving up the per share value of BS&T each time.

The stock last traded October 10 closing at $8.80 on the Barbados exchange. It's last trading price in Trinidad was $TT28.35.

The BSC's action comes a week behind an announced probe by the regulator of what it said might have been breaches of takeover rules.

AMCL's offer climbed as high as B$10 per share before its eventual pull-out on October 16. The withdrawal of the offer, however, came a day behind a statement by Neal and Massy chairman Arthur Lok Jack that the company was unable to go higher than its B$8.50 bid and would be selling its 27.9 per cent shares in BS&T to AMCL.

Neal & Massy then advised shareholders it was going ahead with its offer, but with a variation of the price, amending the cash consideration to only 50 per cent of shares tendered for sale by individual shareholders.

The BSC on Tuesday issued an order for the stock to cease trading Tuesday simultaneously filing an application in the high court for a ruling on the legality of AMCL's withdrawal, as well as Neal & Massy's stated intent preceding the AMCL withdrawal that it would have be tendering its shares to them.

Investors confused

BSC also wants the court to resolve any confusion on the price Neal and Massy is offering, which continues to confuse investors, even after the company placed advertisements attempting to simplify the offer.

The company has not responded to a Financial Gleaner request to comment on the value of the amended offer.

Dulal-Whiteway suggested in a statement that his company's actions would withstand scrutiny, saying they were executed with competent legal advice and were of the "highest standards of integrity and transparency."

lavern.clarke@gleanerjm.com