Nigel Sinclair, Guest Writer

A Government of Jamaica (GOJ) global bond is one of the various investment securities offered to investors by most of our local brokerage firms.

But what is a global bond? A broad definition of a global bond is: A debt obligation issued by a sovereign/entity, oftentimes with high credit rating, within the international markets - usually across several markets simultaneously.

Jamaica has a total of 13 such international issues, most of which are issued in U.S. dollars and are widely held by local investors.

In recent weeks, concerns have emerged relating to the outlook for GOJ global-bond issues, particularly amid signs of instability in the United States, the world's largest financial market.

flight to quality

The latest bout of instability is being fuelled by tightening credit conditions precipitating what is generally referred to as a 'flight to quality'.

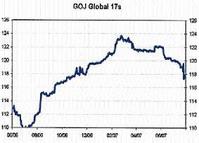

The impact of this movement to safer assets has influenced an apparent fall-off in the prices of GOJ global issues, notably over the last three to four weeks. (See chart.)

Ironically, the decline in prices has come at a time when there has not been any fundamental shift in Jamaica's macroeconomic outlook.

On the contrary, the fiscal accounts, one of the most closely tracked economic indicators by players in the bond market, have been broadly positive - based on readings up to June.

Using the GOJ 17s as the benchmark, bond prices have declined by about three per cent since the start of the year.

Undoubtedly, the recent developments in the U.S. Treasury markets have been influencing the perfor-mance of emerging market securities, including Jamaican credits.

The downturn in the U.S. housing market, the related subprime issues and tightening credit conditions are major factors influencing the movement in U.S. treasuries at this time.

It should be noted that historically, there has not been a strong correlation between GOJ bonds and U.S. treasuries. However, there has been a general trend towards risk aversion by international investors, spurring a move away from emerging market securities.

This has resulted in a general sell-off of riskier assets, which has been largely affecting lower-rated credits like Jamaica (rated B by S&P), and a movement to higher-rated securities such as U.S. treasuries (AAA rating).

As such, GOJ bonds have suffered a fall-off in tandem with most emerging market issues.

Outside of the international concerns, GOJ bonds have also been impacted by relatively tight liquidity in the local market and to some extent, market jitters related to the general election.

Analysts are generally of the view that domestic liquidity conditions is one of the chief factors impacting the movement in GOJ bond prices on account of the estimated 80-90 per cent of bonds held by local investors.

The market has been relatively tight over past months, largely influenced by the timing and size of recent offers by the Government - the US$350 million-2039 issue in March and the US$125 million-Air Jamaica 2027 in June - and other corporate issues.

At the same time the pull of 'high-return schemes', though difficult to quantify, is considered a factor impacting liquidity.

Also in the mix i investor concern about the potential economic impact of the general election.

However, the latter arguably carries the least weighting as there is no clear indication that there is likely to be a radical shift in economic policy in the short term.

GOJ BONDS WILL RECOVER

The concerns about the housing downturn and related issues in the United States are expected to linger over the market for some time, as there is no clear-cut time horizon for the commencement of a recovery.

In addition, market consensus appears to be that the U.S. Federal Reserve is likely to keep the benchmark interest rate steady for the rest of the year, with some economists

speculating on a rate cut early next year, which would be a positive for the bond market generally and emerging market debt securities in particular.

That aside, GOJ bonds are anticipated to recover over the rest of the year, barring any unforeseen downside events.

Liquidity levels are expected to improve over the rest of the year, on account of the GOJ 2017's maturing in September (principal amount US$225M) as well as inflows from regular interest payments on other GOJ debt issues.

At the same time, it is hoped that with the passage of the local elections normality should return to the financial markets as investors set aside pre-election concerns.

GOJ bonds have generally outperformed other emerging market credits over the years.

The GOJ 17, as a benchmark, has realised appreciation of about 36 per cent over the last four years.

On this note, it is reasonable to expect that once the current bout of risk aversion dissipates and international investors renew positions in emerging market bonds, we are likely to see a recovery in GOJ bonds.

Investors are therefore encouraged to capitalise on current opportunities to increase the weighting of bonds in their portfolios.

Bonds, with the exception of junk bonds (rated by S&P at BBB and lower), form part of the low risk investment classes and are generally recommended as a means of diversifying and reducing portfolio risk.

The specific weighting for an investor would be dependent on various factors such as portfolio size and objectives.

In this regard, it is advisable that investors seek the assistance of a reputable financial advisor to offer guidance in portfolio planning.

Nigel Sinclair is research analyst for Guardian Asset Management, Kingston. Email: nigel.sinclair@ghl.com.jm