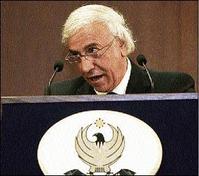

Kurdish Natural Resource Minister Ashti Hawrami appears at a news conference in Irbil, 350 kilometres (217 miles) north of Baghdad, Iraq, yesterday. Iraq's autonomous Kurdish government approved a regional oil law on Tuesday, officials said, paving the way for foreign investment in their northern oil and gas fields while U.S.-backed federal legislation remained stalled. - AP (Reuters):

Crude oil prices rose yesterday, pulling out of a nosedive after news of new refinery problems in the United States rekindled supply worries during the summer driving season.

United States crude oil futures rose US$0.24 cents to US$72.30 a barrel late yesterday, ending heavy losses since last week on economic worries that shaved US$6 off the price and pulled it back from the record. London Brent, meanwhile, rose US$0.63 cents to US$71.80 a barrel.

Sources said ConocoPhillips shut processing units at two oil refineries on the U.S. East Coast for repairs, including a unit at its big Bayway plant in New Jersey. A ConocoPhillips official was not immediately available.

"The market was rallying on the Conoco Bayway (gasoline unit) problems," said Nauman Barakat, senior vice-president at Macquarie Futures USA.

Tight supplies

Shutdowns at oil refineries in the world's largest energy consumer have kept supplies tight since spring, contributing to a record run in gasolene pump prices earlier this year to well-over US$3 a gallon.

Oil had fallen below US$72 a barrel earlier on Tuesday, extending the previous session's near five per cent plunge sparked by concern about the U.S. economy and falling equity markets.

The U.S. sub-prime, or risky, mortgage crisis has rattled credit and stock markets and is spillingover into commodities, analysts say. Some investors say oil may head lower still in the near term.

"It might get to the high US$60s. High $60s, low US$70s is a healthy level. That is a level the world economy is happy with," said Badung Tariono at ABN Amro Asset Management.

U.S. stocks fell after data showing a higher-than-expected rise in a measure of labour costs in the second quarter. European equities moved higher, as did some industrial metals such as copper.

Oil speculations

In oil, speculators who boosted net long positions, or bets prices will rise, on the New York Mercantile Exchange to a record the previous week have been among the biggest sellers, say traders.

Net speculative long positions stood at 237 million barrels last Friday and investors may have sold the equivalent of about 85 million barrels, according to Goldman Sachs. A drop in net speculative length to 85 million barrels could knock up to US$10 to US$12 a barrel from the price of U.S. crude, Goldman said.

"Further liquidation could cause (U.S. crude) prices to drop by another $5 a barrel," the bank said in a research note.

But oil remains up from about US$50 in January due to real and threatened disruptions to crude oil supply, constraints at oil refineries, resilient demand and a flow of investor money into commodities.

The reluctance of the Organisation of the Petroleum Exporting Countries, which began curbing supply late last year, to increase crude output, has limited price declines.