Dennise Williams, Staff Reporter

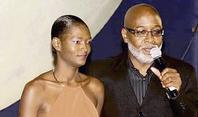

Kingsley Cooper, (right) Pulse's executive chairman, and international model, Nadine Willis. - FILE

BEFORE APRIL, one more name will be added to the roster on the Jamaica Stock Exchange (JSE) - Pulse Investments.

The JSE board approved the application for the re-listing last month, the exchange stated in a release yesterday.

It said Pulse had met the necessary requirements to be listed, including an application for listing and the provision of all financial and current reports that were outstanding prior to de-listing.

The company listed its principal activities when it was first listed in 1993, as model agency representation, show promotion and grooming

school training.

Kingsley Cooper, executive chairman of Pulse Investments said, "We were advised by the JSE in their letter dated January 27, 2006 that the council had approved our listing application at its meeting on January 25, 2006. We plan to actually list during March, 2006, subject to the advice of the JSE."

NOT NEW ON EXCHANGE

This is not a new name to the JSE, as Pulse was listed before.

Pulse Investments Limited went public in 1994 with issued share capital of 15,774,884 shares at $2.00 per share.

The shares last traded on the JSE in April 1996, and in May 2001 the JSE de-listed the company for failure to file its audited accounts for the four years, 1997, 1998, 1999 and 2000.

"We are not proud of the fact that we were de-listed in the first instance due to our failure to submit returns on time," Mr. Cooper says. "In the present atmosphere of severely increased scrutiny and regulation, compared with what obtained when we were de-listed, it is obvious that Pulse has been subjected to the most rigorous examination before being considered for re-listing."

Of course, the all-important question is the one of price.

Mr. Cooper told Wednesday Business that "Shares will commence trading at $4.01, which was the book value of the stock in early 2005.

The book value is currently in the region of $5.00 as a result of profitable operations over the past year."

Pulse is not asking investors to put in fresh money, as Mr. Cooper explains, "Pulse is being listed. There is no fund-raising exercise, no public offer. Accordingly, there is no underwriter."

Pulse Investments Ltd. will be listed through the method of 'introduction', as none of the company's securities are offered to the public, the JSE stated.

Asked just what investors would be buying into, Mr. Cooper answers, "The potential of the entertainment market is vast. The list of Jamaica's entertainment "products" is an enviable one - from Bob Marley and Jimmy Cliff to Sean Paul and Shaggy. In Pulse's case, I need only mention Jaunel McKenzie, the world's top black model and Nadine Willis, the first black Gucci girl."

Mr. Cooper has a very favourable outlook on the prospects for his company going forward. He said, "In the last few years our net worth has increased more than twenty fold (currently in the region of $650 million), our consolidated debt to financial institutions has been reduced from over $150 million to around $12 million and our revenues and profits have shown significant annual growth. We hope to continue that performance."

After the company was de-listed it re-structured by merging the assets of Pulse Entertainment into Pulse Investments and liquidated most of its debts by issuing shares to the creditors of Pulse Entertainment, the JSE stated.